European Hemp Market

The EU has an active hemp market, with production in most member nations. Production is centered in France, the Netherlands, Lithuania, and Romania. France is the main producer of hemp, accounting for almost 50% of Europe’s total production. Baltic area has rapidly emerged to become the region’s second biggest hemp grower.

Many EU countries lifted their bans on hemp production in the 1990s and, until recently, also subsidized the production of “flax and hemp” under the EU’s Common Agricultural Policy. Most EU production is of hurds, seeds, fibers, and pharmaceuticals. Europe, particularly France and Finland, have a long history using hemp for fibres, construction material and textiles, though in the last 25 years this sector has come into bloom, increasing production by upwards of 500% (that’s 250% in 8 years).

The demand for hemp has been fueled by the increasingly diverse use of this crop. In 2019 and 2020, European cultivation grew by over 20% and almost 40% from 2018 and European countries produced hemp 48,000 and 55,000 correspondingly hectares – a record high and accounting for about 20% of FAO-reported global acreage. This marks significant growth since 2011 when there was a total of 8,000 hectares used for hemp cultivation.

The EU has subsidized the European hemp market over the last 20 years as part of green policy initiatives. However, with greater demand and stronger prices being recorded, the European market is beginning to move towards a free market model.

In 2020 production in EU was centered in France (44,232 acres), Germany (13,250 acres), Lithuania (13,097 acres), Estonia (12,753 acres), the Netherlands (9,467 acres), Romania (8,398 acres), Poland (7,410 acres), Italy (4,000 acres) and Austria (3,910 acres). Many EU countries lifted their bans on hemp production in the 1990s and, until recently, also subsidized the production of “flax and hemp” under the EU’s Common Agricultural Policy. Most EU production is of hurds, seeds, fibers, and pharmaceuticals.

The market for industrial hemp in Europe accounted for a revenue share of 22.2% in 2019, or about €1 billion, on account of its use in automotive parts, construction materials, textiles, and fabrics in the form of fibers. The value of all hemp-based product markets combined (CBD, hemp bioplastics, insulation, hemp concrete and other) in Europe was estimated at €1.62 billion in 2020, increasing to €6.3 and €8.8 billion in 2025 and 2030 respectively.

European CBD Market

Hemp is also an excellent source of CBD, which can be extracted for use in an array of food supplements, pharmaceuticals and cosmetics. Although the legal cannabis market in Europe is targeted strictly towards medical consumers, the consumption of hemp-derived CBD infused products for recreational purposes is legally permitted across much of the continent.

Within Europe, select countries have a more profound impact on the CBD market. For instance, Switzerland legally permits the sale, possession, and consumption of both legal and recreational CBD with a THC content as high as 1.0 %. Furthermore, CBD products are available for purchase in tobacco shops. As a result, the softening of THC limitations and ease of consumer access makes Switzerland one of the biggest European players within the CBD market.

As detailed in IHS Markit’s latest release, the total EU CBD market value is estimated at €1.6 billion in 2020 and it is projected to grow at a combined annual growth rate (CAGR) of 18.5%, to reach €8.7 billion by 2030. The two biggest markets for CBD are Germany and the United Kingdom (U.K.), representing around €350 million and €330 million. By 2030, the research firm expects spending in Germany and the UK to grow to €1.95 billion and €1.82 billion, respectfully.

European Hemp/CBD Market Inforgraphics

Europe Hemp CBD Business Plan Sample

'70% ready to go' business plan templates

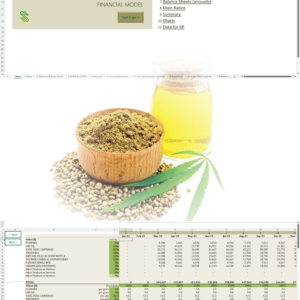

Our hemp/CBD financial models and business plan templates will help you estimate how much it costs to start and operate your own hemp/CBD business, to build all revenue and cost line-items monthly over a flexible seven year period, and then summarize the monthly results into quarters and years for an easy view into the various time periods. We also offer investor pitch deck templates.

Best Selling Templates

Cannabis business plan templates are available at cannabusinessplans.com.