Hemp fiber being a renewable resource is used in the production of daily use products such as paper, textiles, fuel, and construction materials and the growing demand for eco-friendly products will significantly contribute to the growth of the hemp industrial market. Breathability, antibacterial, and sustainability are key properties involved in the production of hemp fiber products.

The hemp fiber segment dominated the global industrial hemp market in 2023 on the basis of application with 23.56%, mainly due to the growing demand for hemp fabric.

The Asia-Pacific region is expected to dominate the industry over the next five years, with China, the main producer, leading in terms of share of the country. China alone is responsible for 50% of hemp production and has around 600 international patents. Government support for the industrial use of hemp, along with favorable environmental and agricultural conditions, has promoted to the country’s contribution to the industry.

The European market will witness significant growth and demand will be heavily influenced by ongoing research on green building solutions in the UK, Spain and France. Other factors, such as the increase in the number of hemp growers since the start of industrial use, have prompted hemp fiber to be used in other industries.

North America is expected to forecast the largest gains by 2026. Strong commercialization with mass production will affect the industrial growth of the region. New Frontier Data projects the U.S. hemp fiber market to grow at a compound annual growth rate (CAGR) of 10.5% from 2020 to 2025 to reach $77.7 million.

Preliminary data shows about 45,000 acres were licensed in the U.S. in 2023, with more than 21,000 acres planted, according to HempBenchmarks.com. Hemp floral varieties accounted for about 38% of total harvested acreage, fiber 37%, and grain and seed 25%.

As seen in Europe, which has the longest experience in fiber hemp cultivation, it is likely that products that require the least processing and calibration will be the first to achieve market viability in North America. As the industry matures, increasingly profitable hemp fiber applications should become viable.

A survey of fiber processors by New Frontier Data showed that they expect the best five-year growth potential among segments including construction materials, automotive parts, bioplastics, and nonwoven textiles, respectively.

In recent years, research has shown a positive aspect of hemp fabrics versus cotton. Economical, fewer toxin, and high crop culture are the main reasons for replacing cotton with hemp in the coming years. Change in consumer choices along with increasing awareness about product quality and properties has altered the textile industry. In addition, the selection of the best substitutes took into account the need to reduce dependence on a single source fabric.

Strong demand from the construction industry due to product compliance with the green building concept has influenced the penetration of hemp fiber into the construction industry. Favorable factors such as light-weightiness, breathability, improved building temperature and humidity, and better insulation are key factors to affect demand in the industry.

Hemp-based automotive components offer auto manufacturers a means to both reduce the weight of their vehicles and reduce their carbon footprint. However, while the stability of the European hemp market has allowed automakers to integrate its materials into their manufacturing processes, the immaturity of North American markets has slowed down progress towards similar integration among U.S. automakers. As the U.S. market matures, knowledge transfer within companies operating in both Europe and North America will help facilitate the use of hemp in North American-made vehicles as the materials become widely available.

Hemp Fiber Market Infographics

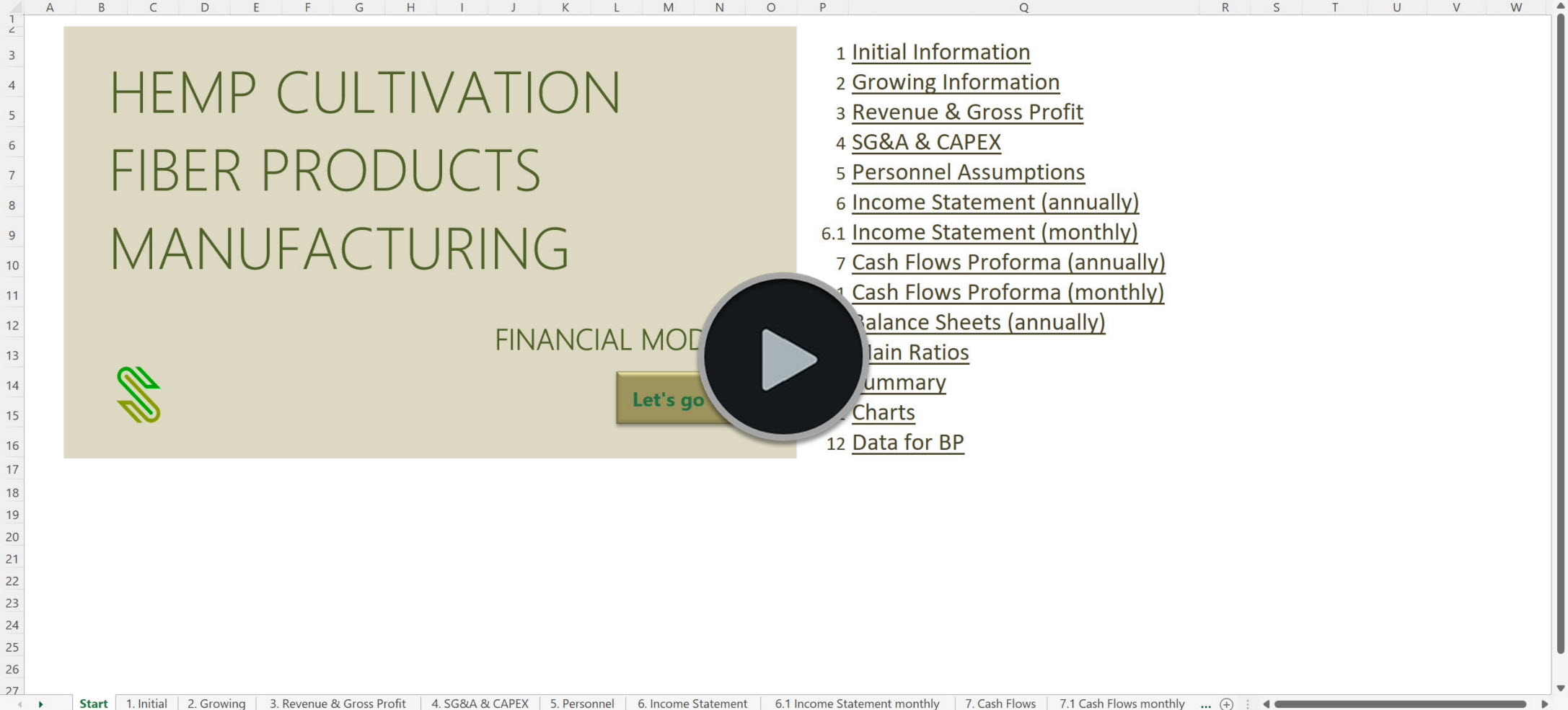

'70% ready to go' business plan templates

Our hemp growing for fiber and manufacturing a range of fiber products business plan templates will help you estimate how much does it cost to start and operate your own hemp business, to build all revenue and cost line-items monthly over a flexible seven year period, and then sums the monthly results into quarters and years for an easy view into the various time periods.

Should you have any questions, please do not hesitate to contact us.