Of the world’s surface area suitable for sustainable production expansion – that is, non-protected, non-forested land, with low population density – Africa has the largest share by far, accounting for roughly 45% of the global total (World Bank). Currently, 11 countries are reported to allow the growing of industrial hemp in Africa, including Botswana, the Kingdom of eSwatini, Ghana, Lesotho, Malawi, Morocco, Rwanda, South Africa, Uganda, Zambia and Zimbabwe. Most countries adopted the 0.3% THC standard used in the United States and other countries for hemp plants, but Malawi and Zimbabwe set the limit between marijuana and hemp at 1.0%.

| Population 2024 (b) | 1.49 |

| GDP 2024 (US$ t) | 2.81 |

| Share of the world’s surface area suitable for sustainable production expansion | 45% |

| Source: World Bank, IMF | |

Although there are very limited quantities of CBD products available in Africa the continent shows off an ever-growing market. One of the main reasons CBD consumer goods are set to increase its popularity in the continent is that Africans are moving to the city. Africa’s population of roughly 1.2 billion is expected to double by 2050 with more than 80% of that growth will live in cities.

“Industrial hemp can be alternative crops to offset contraction of the tobacco market,” says the New Frontier Data report (The Africa Regional Hemp and Cannabis Report: 2019 Industry Outlook). Africa has various advantages including affordable land, low-cost labour and an experienced agricultural workforce. Challenges facing the African hemp industry include a lack of infrastructure and investment, transport networks and storage facilities, limited access to markets due to a lack of established supply chains and export infrastructure, and a lack of clear regulations and policies regarding hemp cultivation and processing in some African countries.

The Hemp Business Journal estimates hemp retail sales in African markets at $133 million in 2022.

Botswana

In 2022, the Gaborone High Court in Botswana granted Botswana company Fresh Standard permission to grow hemp for medicinal and industrial purposes.

The Kingdom of eSwatini

In January 2019, Profile Solutions Inc. became the only licensed growing farm and processing plant for medical cannabis and industrial hemp in The Kingdom of eSwatini.

Ghana

In 2020, Ghana’s parliament passed legislation that legalizes the use of cannabis for medical and industrial purposes and gave the country’s Narcotics Control Board (NACOB) charge of industrial hemp. Legislation permits medical cannabis and industrial hemp with a THC content of 0.3%. The bill was later rejected by the country’s highest court, which ruled it unconstitutional because it had not been discussed in Parliament. In 2023, Parliament voted for the measure, officially the Narcotics Control Commission Amendment Bill 2023, which now awaits President’s signature to become law.

Lesotho

On February 28, 2017, Lesotho Ministry of Health and Social Welfare granted the first license to legally cultivate, supply, hold, import, and export cannabis. In Lesotho, CBD is legal for medical use and must not contain more than 0.03% THC.

Malawi

In February 2020, Malawi’s parliament passed a bill that makes it legal to cultivate and process cannabis for medicines and hemp fibre used in industry. Any cannabis plant with a THC content below 1.0% is classified and registered as industrial hemp in Malawi.

Morocco

On 26 May 2021, the Moroccan government approved a bill to regulate medical cannabis and industrial hemp. As of April 2021, Malawi’s Cannabis Regulatory Authority (CRA) has issued 86 licenses to 35 companies and co-operatives in the categories of cultivation and sale, processing, storage, distribution research to be used for medicinal and industrial hemp.

Rwanda

In June 2021, Rwanda passed the new order No 003/MoH/2021 legalising the cultivation, processing, and sale of medical cannabis for both exportation and domestic use. Under the new law, eight types of licenses will be available. The licenses will be valid for five years.

South Africa

In South Africa, the law, valid until the end of May 2020, allowed the sale and use of some CBD products over the counter. In June 2020, the country exempted industrial hemp with less than 0.2% THC from medical control and rescheduled CBD to be regulated as a supplement on schedule 0:

- CBD medication marketed for general health, or the “relief of minor symptoms” containing no more than 600 mg of CBD per pack and provide a maximum daily dose of 20 mg.

- Ingestible products derived from raw biomass that contain no more than 0.0075% total CBD and only the naturally occurring cannabinoids found in the source material.

In 2023, the Department of Agriculture and Rural Development (DARD) issued a total of 664 licenses in the South African province of KwaZulu-Natal. The permits authorize the farmers to grow, store and transport cannabis with less than 0.2% THC – the dividing line between hemp and marijuana in South Africa. South Africa’s cannabis/CBD industry is expected to grow at a CAGR of 28.4% between 2022 and 2026.

Uganda

In August 2023, Parliament passed the Narcotics and Psychotropic Substances Bill 2023, which now allows for the licensed cultivation and use of cannabis for medical purposes only, following the annulment of the Narcotic Drugs and Psychotropic Substances Control Act 2017 by the Constitutional Court in May 2023.

Zambia

In December 2019, Zambia’s cabinet took the decision to legalize production and export of hemp for the medical and commercial market. Licensing will be carried out by the Ministry of Health and commercial cultivation will be supervised by the Zambia National Service.

Zimbabwe

Zimbabwe decriminalized hemp growing in 2018 and in February 2019, harvested their first crop of legally grown industrial hemp. The industry regulations were released in October 2020. A total of 57 licenses were issued to both foreign and local enterprises.

In 2022, the Medicines Control Authority of Zimbabwe (MCAZ) announced a change in a recent circular opening up the domestic market for CBD as a traditional herbal medicine, expanding on previous laws that only allowed production for export.

Amended legislation in 2023 removed industrial hemp from the country’s list of dangerous drugs and set the defining limit between marijuana and hemp at 1.0%.

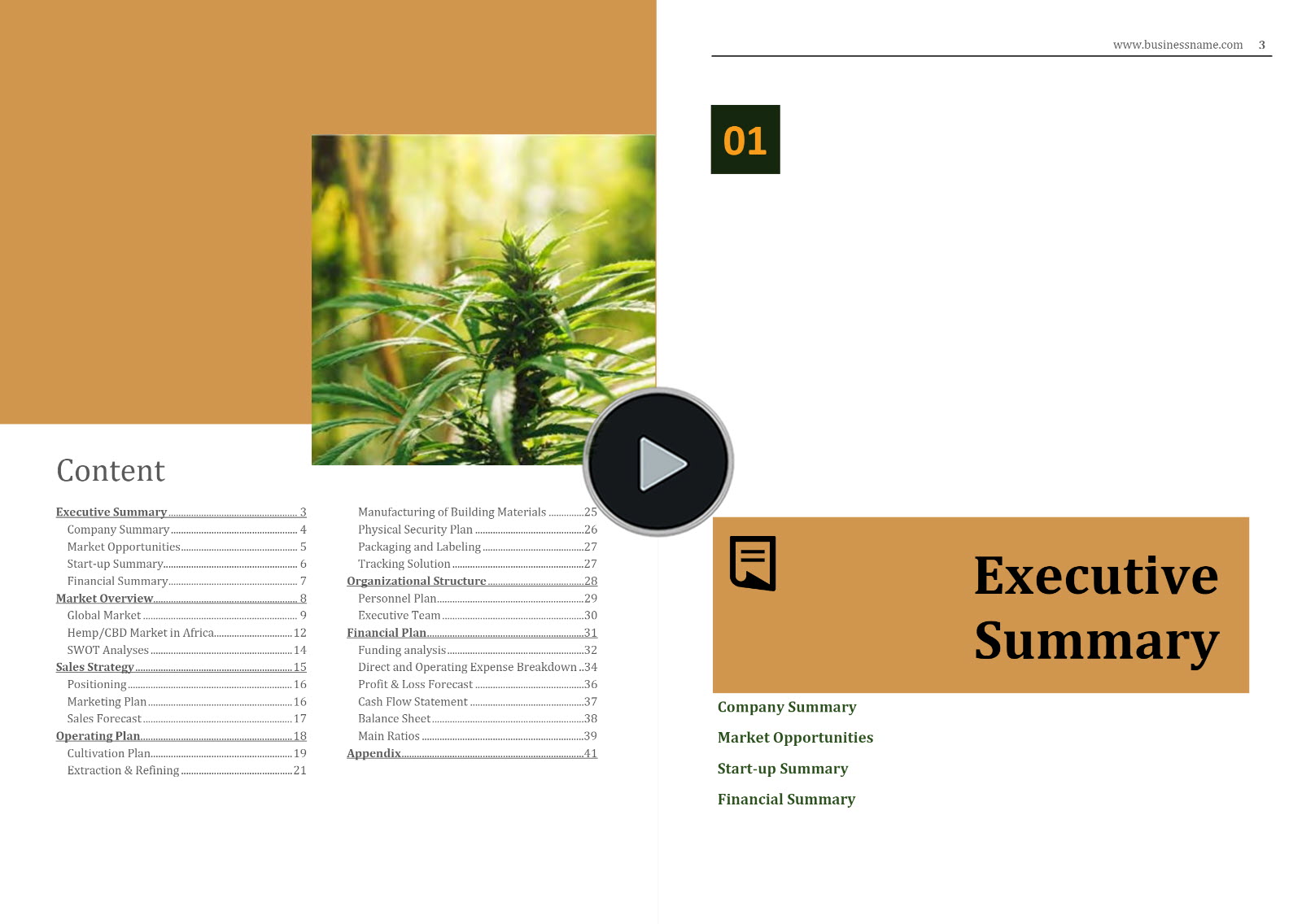

Africa Hemp Market Infographics

Africa Hemp CBD Business Plan Sample, South Africa

'70% ready to go' business plan templates

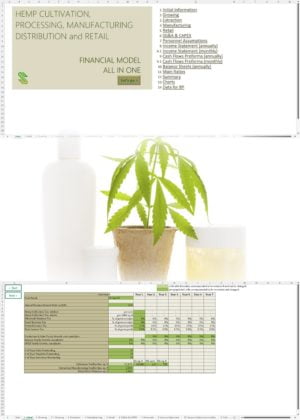

Our hemp/CBD financial models and business plan templates will help you estimate how much it costs to start and operate your own hemp/CBD business, to build all revenue and cost line-items monthly over a flexible seven year period, and then summarize the monthly results into quarters and years for an easy view into the various time periods. We also offer investor pitch deck templates.

Best Selling Templates

Templates for a cannabis business are available at cannabusinessplans.com.