| Population 2024 (m) | 669 |

| GDP 2023 (US$ t) | 6.94 |

| Share of total farming land worldwide | 33% |

| Industrial hemp area, 2023 (ha) | 10,000 |

| Industrial hemp area, 2030 (ha) | 50,000 |

| Source: World Bank | |

Since 2013, several Latin American countries have legalized the production of industrial hemp, including Argentina, Colombia, Costa Rica, Paraguay, Ecuador and Uruguay. Latin American fiber hemp is in its infancy, while grain varieties are more developed. South American countries are expected to become major players in the global hemp market over the next few years. In 2023, main producers included Paraguay, Colombia, Uruguay.

The size of industrial hemp area in Latin America and the Caribbean is estimated at approximately 10,000 hectares in 2023 and is projected to reach 50,000 hectares by 2030. Currently, hemp/CBD products commercialised in Mexico, Bahamas, Bermuda, Antigua and Barbuda, Aruba, Trinidad and Tobago, Colombia, Ecuador, Costa Rico, Peru, Paraguay, Chile, Uruguay, Argentina. In the second edition of the Latin America and Caribbean Cannabis Report – produced by London-based advisory group Prohibition Partners – the cannabinoid-based products market is projected to reach over $500 million by 2024 with over 50% of CBD products sales.

Latin America and the Caribbean Hemp CBD Business Plan Sample

Argentina Hemp

The proposed law advocates whole-plant usage and exploitation of hemp for its health, environmental and economic development benefits. In August 2023, the rules were published in the government’s official gazette setting the THC level for Argentinian hemp at a full 1.0%. The rules exclude CBD production, which is limited by a 2020 decree under which CBD and THC-based products are allowed for import, but only for patients, and sales are limited to pharmacies with doctors’ prescriptions. Permitted hemp uses include human and veterinary medicinal products, food, cosmetic, industrial, as well as future applications that may arise from ongoing research and technological developments. The government pledged to invest more than $100 million in hemp research initiatives.

Brazil Hemp

In 2022, farming occupied a third of Brazil’s territory, or 282.5 million hectares, about ten times more than, for example, France. Hemp oil was legalised for medical cannabis products in 2015, however, Brazil does not allow its production within the country. On June 8, 2021, the Brazilian Chamber of Deputies’ Special Commission approved PL 399/2015, which would authorize the production and marketing of products made from industrial hemp as long as they are not intended for medical use or marketed for “prophylactic, curative or palliative purposes.” It would clear the way for products in health and beauty, cellulose, fibres and non-medical veterinary as long as those products contain less than 0.3% THC with seeds would be allowed in foods.

Chile Hemp

In 2015, Chile’s president, Michelle Bachelet, signed a decree that removed cannabis from the ‘hard drug’ list. Medicinal cannabis and hemp-derived and marijuana-derived CBD were authorized for pharmaceutical products in December 2015.

According to the latest FAO data, in 2021 Chile ranked 9th by hemp fiber production and 6th by hemp planted area with 4,216 tonnes and 4,476 hectares respectively.

Chile is expected to be the largest market in the region and would account for around 39% of Latin America’s industrial hemp market.

Colombia Hemp

In 2017, President Juan Manual Santos signed the decree 613 of 2017, permitting individuals and businesses to engage with the cannabis industry. There are 4 types of licenses for producing cannabis including cultivation of non-psychoactive cannabis plants. In Colombia, cultivars remain legal with a THC limit of 1%. There were about 400 hemp cultivation licenses in 2020 and nearly 2,400 active licenses in 2022.

Currently, Colombia is already exporting their hemp seeds to other countries while farmers are focused on producing non-psychoactive strains, specially cultivated for CBD and bioenergy purposes.

Costa Rica Hemp

The commercialization of CBD products (including food, beverages and cosmetics) is allowed in Costa Rica as long as they are 100% THC-free. Costa Rica’s proposed Law No. 10.113, entitled “Cannabis Law for Medicinal and Therapeutic Use and Hemp for Food and Industrial Use”, was passed by the Legislative Assembly in January 2022 and signed into law by Costa Rica President Carlos Alvarado in March 2022.

The Ministry of Agriculture (MAG) is responsible for hemp cultivation licenses, while those wishing to import raw materials with CBD and produce hemp products in Costa Rica must apply to the Ministry of Health for authorization to manufacture hemp derivatives or hemp products of health interest.

As of May 2023, the MAG has issued a total of nine permits, including eight hemp cultivation permits and one medical cannabis license.

Ecuador Hemp

In June 2020, the new legislation regarding hemp was approved and in November 2020, regulations were released from the Ministry of Agriculture for licensing in the cultivation, processing, commercialization and export of industrial hemp and medicine up to 1% THC with seven types of licences:

- Import and sale of seeds.

- Production and sale of seeds and cuttings.

- Production of non-psychoactive seeds and industrial hemp.

- Production of industrial hemp.

- For plant breeding and germplasm banks.

- Production and processing of derivatives.

- For commercialization and export.

Ecuador regulations allow for a whole plant approach. About 200 hectares grown in 2022, mainly for flower biomass for CBD. According to the Prohibition Partners second edition report, the country aims to have between 40,000 and 50,000 industrial hemp cultivated hectares between 2030 and 2035, with expected three to four yearly harvests.

Jamaica Hemp

In 2015, the Jamaican government passed a number of important amendments to the Dangerous Drugs Act, decriminalizing cannabis and introducing licenses for its cultivation and sale.

Mexico Hemp

On June 19, 2017 President Enrique Peña Nieto signed a bill into law that officially legalized the cultivation, production, and use of medical cannabis products with less than 1% THC in Mexico.

Mexico is the second largest Latin American market for industrial hemp products, taking a 15% share. The Mexico hemp CBD market size was estimated at $11 million in 2022 and is projected to grow at a CAGR of 26% from 2023 to 2030. The pharmaceutical segment dominated the market in 2022 with a revenue share of over 45%.

Panama Hemp

The Central American country legalized medical cannabis in October 2021. Regulations for legal companies that import, export, grow and sell cannabis and cannabis products for medical or scientific purposes were adopted in 2022. Panama’s Ministry of Health regulates the production, import and sale of hemp/CBD products, including CBD oil.

Paraguay Hemp

In October 2019, Paraguay passed a law allowing for the cultivation of hemp up to 2 hectares per family, with estimates from Paraguayan authorities of about 25,000 families interested in the business. In August 2020, Paraguayan president Mario Abdo Benítez signed a decree that places hemp as a ‘national interest crop’.

In 2020, five companies were authorised to cultivate industrial hemp in Paraguay: Evonia, Alquimia, International Market, Healthy Grain and Irupe. In September 2020, Healthy Grains S.A. announced the first export of hemp food in South America to the US, exporting 500 kilograms of hulled seeds, 350 kilograms of powder and 150 kilograms of oil.

It is estimated that in 2022, 350-400 individual farmers have planted about 2,500 hectares of hemp in Paraguay, mainly for grains and biomass, also some for fiber.

Peru Hemp

On February 23rd, 2019, the government approved the regulation of Law No. 30681 that regulates the medicinal and therapeutic use of Cannabis plant and its derivatives. The decree specifically identifies that non-psychoactive cannabis, and its derivatives are not controlled substances.

Companies with registered products must obtain the necessary import permits to be able to receive the shipments and distribute to pharmacies around the country.

Uruguay Hemp

Cannabis and hemp have been legal in Uruguay since 2013. Uruguay allows up to 1% THC in its hemp production. About 400 hectares were planted in 2016, and in 2017, nine companies received authorization to plant around 1,200 hectares, according to the country’s Ministry of Agriculture.

Hemp-related licences are increasing exponentially, jumping from 14 licences in early 2019 to 40 in January 2020, a 185% increase in one year. In July 2020, hemp producer Cplant shipped 524 kilograms of hemp to Switzerland, the first export of hemp from Uruguay. In August 2020, 1,300 hectares were authorised for hemp cultivation in the country.

The Ministry of Livestock, Agriculture and Fisheries (MGAP) estimated the total hemp export from Uruguay in 2020 to be between 50 and 60 tonnes.

In 2023, a Uruguayan company shipped 10 tonnes of CBD flower to the United States, which is the largest hemp export to the country from Uruguay to date.

In 2023, representatives of Germany and Uruguay met for preliminary negotiations to prepare a joint project on hemp fiber.

Latin America Hemp CBD Industry Infographics

Business Plan Sample for a Hemp Cultivation and Processing Business in Paraguay

'70% ready to go' business plan templates

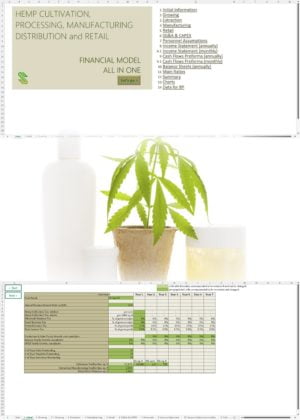

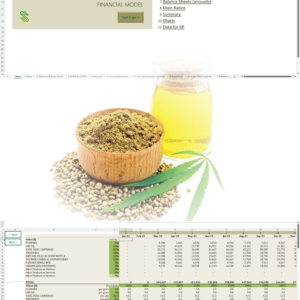

Our hemp/CBD financial models and business plan templates will help you estimate how much it costs to start and operate your own hemp/CBD business, to build all revenue and cost line-items monthly over a flexible seven year period, and then summarize the monthly results into quarters and years for an easy view into the various time periods. We also offer investor pitch deck templates.

Best Selling Templates

Cannabis business plan templates are available at cannabusinessplans.com.